Approximately 1 year ago, I wrote an article, saying two

markets were screaming buys if investors could hold for a year.

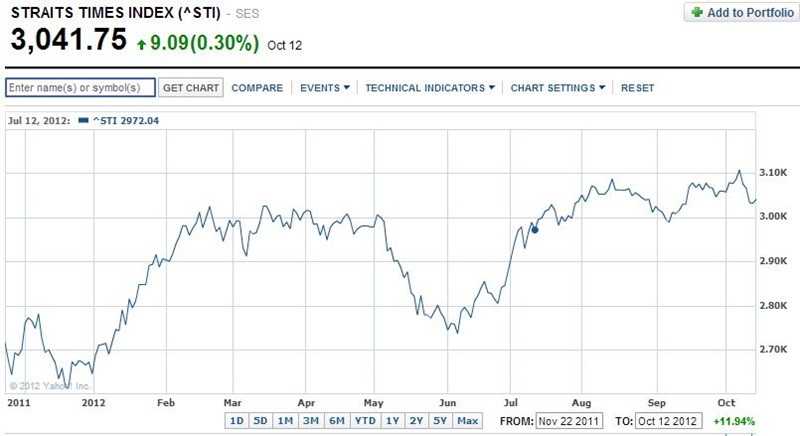

The date was 22 November 2011; the call was 22 November was

an attractive entry point for Singapore and Hong Kong, and in Asia ex Japan equity

markets. I’d like to say I did deep economic analysis of the markets, but it

was based mostly on valuations.

Since 22 November, all three markets have shown 10%+

returns.

The Hang Seng Index, representing the Hong Kong market, is up 15.81%, in HKD terms. Meanwhile, closer to home, the STI is known to be the boring sister to the HSI…

|

| Image credit: http://finance.yahoo.com |

…but that didn’t stop her from putting in 11.9% returns

since 22 Nov 2011 in SGD terms.

|

| Image credit: http://finance.yahoo.com |

In USD terms, the MSCI Asia ex Japan (represented by its iShares

ETF) returned 13.3%.

|

| Image credit: http://finance.yahoo.com |

Like I mentioned, there wasn't a whole lot of intelligence

behind this decision – it’s essentially a look at valuations, which, at the

time, were way low. Maybe it’s blind luck, but it’s always nice to know I’m

right. This time anyway.

No comments:

Post a Comment